Google profits from ads promoting ‘instant’ money and loans delivered ‘faster than pizza’ despite pledging to protect users from ‘deceptive and harmful’ financial products. The adverts were shown to people in the UK who searched for terms such as “quick money now” and “need financial help” and directed users to companies offering high interest loans. […]]]>

Google profits from ads promoting ‘instant’ money and loans delivered ‘faster than pizza’ despite pledging to protect users from ‘deceptive and harmful’ financial products. The adverts were shown to people in the UK who searched for terms such as “quick money now” and “need financial help” and directed users to companies offering high interest loans. […]]]>

Google profits from ads promoting ‘instant’ money and loans delivered ‘faster than pizza’ despite pledging to protect users from ‘deceptive and harmful’ financial products.

The adverts were shown to people in the UK who searched for terms such as “quick money now” and “need financial help” and directed users to companies offering high interest loans.

One, listed in Google search results above links to the government website and debt charities, promised “guaranteed money in ten minutes” for people with “very bad credit”.

The Advertising Standards Authority said last night it was assessing 24 adverts identified by the Observerpaid for by 12 advertisers, including loan companies and credit brokers as well as suspected scammers.

The regulator said many of the promotions were likely to breach rules on socially responsible advertising which state that advertisements must not “trivialize” loan underwriting. “A disproportionate emphasis on speed and ease of access to interest rates is likely to be considered problematic,” according to its guidelines.

Google said the ads flagged with it violated its policies and had been removed. He previously pledged to fight “predatory” loan promotions, banning ads for payday and high-interest loans in 2016.

The promotions appeared to clearly violate its policy, explicitly referring to “payday loans” and linking to websites offering ultra-high interest rates of up to 1,721%. Many ads removed by Google on Friday had been replaced by similar promotions within hours, some from the same advertisers reported by the Observer.

It comes amid a growing cost of living crisis, described by the Institute for Fiscal Studies as the worst financial crisis in 60 years.

Households are battling rising prices on multiple fronts, including rising energy bills, grocery costs, and gasoline and diesel prices, compounded by supply chain disruptions and issues caused by the pandemic, Brexit and the war in Ukraine.

Charities and debt campaigners have said such loans could trap people in financial difficulty, who may impulsively apply and find themselves “trapped in a spiral”.

Adam Butler, head of policy at debt charity StepChange, said financially vulnerable people were most likely to be drawn in “due to a complete lack of borrowing alternatives”. “The repeated use of these types of products to make ends meet – often the reason people turn to this type of borrowing – can trap people in a spiral that is very difficult to get out of,” a- he declared. “With the cost of living crisis set to worsen further in the coming months, there is every chance that we will see an increase in the number of people forced to turn to this type of borrowing just to s ‘get out.”

Many promotions appeared to be deliberately aimed at people in financial difficulty, with messages such as “bad credit, welcome”. They suggested there would be little review with messages such as “no credit check” and “no call”.

An ad read: “Instant payday loans paid in 10 minutes. Bad credit OK, irrelevant credit history. Another company described the loans available as suitable for “small emergencies”.

Another website, Tendo Loan – one of the most prolific advertisers – claimed to offer: “Cash in 10 minutes guaranteed. 3-36 months. No credit checks! It added: “A loan delivered faster than pizza! 2 minutes to apply and 10 minutes to deposit to your account. Apply 24/7. Tendo Loan did not respond to requests for comment.

The Financial Conduct Authority said adverts suggesting the loans were ‘secured’ or involved ‘no credit checks’ were misleading. He said companies should not make ‘false’ claims, such as suggesting that credit is available regardless of a customer’s financial situation or status, and could be subject to action of execution.

In some cases, the advertisements appeared to be linked to fraudulent websites, redirecting users to websites where they entered their personal information, including banking information, phone number, date of birth and address.

Yvonne Fovargue, chair of the all-party caucus on debt and personal finance, described the ads as “online harm” and called on Google and the government to tackle them.

“It’s an obvious targeting ploy for people on the edge who, instead of taking out a loan, should seek debt advice,” she said.

The ASA has previously ruled against payday lenders and said it is evaluating evidence of potential violations.

He added that while “the responsibility ultimately rests with the advertiser”, media platforms such as Google “also have some responsibility to ensure that content complies with the rules”. “Platforms should and are taking steps to ensure misleading and irresponsible ads are not posted,” a spokesperson said.

Google said, “We have strict advertising policies in place for financial services products and prohibit ads for payday loans. We have a dedicated team working to protect users from malicious actors trying to evade detection. In 2020, we blocked or removed over 123 million ads for violating our financial services policies. »

Stella Creasy, anti-payday lending campaigner and Labor MP for Walthamstow, described companies offering super-high-interest short-term loans as ‘legal loan sharks’ who seek to ‘exploit’ people’s financial difficulties. “We need the government and regulators to remain constantly vigilant and act to stop these companies before they make a bad situation worse for so many people,” she said.

MoneyMutual is a payday loan company that lets you borrow from $200 to $5,000 in as little as 24 hours. By filling out a simple form on MoneyMutualyou can instantly connect to 91 lenders to find the best deal in your area. Is MoneyMutual legit? How does Money Mutual work? Keep reading to find out […]]]>

MoneyMutual is a payday loan company that lets you borrow from $200 to $5,000 in as little as 24 hours. By filling out a simple form on MoneyMutualyou can instantly connect to 91 lenders to find the best deal in your area. Is MoneyMutual legit? How does Money Mutual work? Keep reading to find out […]]]>

MoneyMutual is a payday loan company that lets you borrow from $200 to $5,000 in as little as 24 hours.

By filling out a simple form on MoneyMutualyou can instantly connect to 91 lenders to find the best deal in your area.

Is MoneyMutual legit? How does Money Mutual work? Keep reading to find out everything you need to know about this payday loan website.

What is MoneyMutual?

MoneyMutual, available online at MoneyMutual.com, is a payday loan website that lets you get anywhere from $200 to $5,000 deposited into your account within 24 hours.

Simply complete the form on MoneyMutual.com to get started and you can instantly see offers from lenders serving your area.

MoneyMutual is one of the most trusted payday loan websites available online today. With over 2,000,000 customers to date, MoneyMutual has a proven track record of providing customers with the payday loans they need. You can see MoneyMutual commercials on TV, and TV’s Montel Williams was a spokesperson for MoneyMutual for almost a decade.

How does MoneyMutual work?

MoneyMutual makes it easy to get a short term loan in 24 hours or less and is easily one of the best bad credit loan providers of 2022.

As long as you’re 18, have at least $800 a month of verifiable income, and have a checking account, you should be able to find a payday loan through MoneyMutual.

Simply enter your information into MoneyMutual.com, then view payday lender offers. MoneyMutual partners with over 90 companies to ensure customers can get the payday loans they need when they need them.

After choosing the offer via MoneyMutual’s online comparison screenyou visit the lender’s website, fill in additional information and get the money you need as soon as possible.

Here’s how it works:

- Step 1) Provide your information: Fill out the form on MoneyMutual.com and MoneyMutual sends your information to the lenders.

- Step 2) Lender Review: Lenders verify your information instantly to determine the right person. Then they show you their best offer on the next page.

- Step 3) Get your money: Browse a list of loan offers and get funds deposited into your bank account in as little as 24 hours.

You can use MoneyMutual for loans ranging from $200 to $5,000.

How much does Money Mutual cost?

MoneyMutual is available for free. You fill out the form and submit your information for free via the online marketplace.

However, once you choose a lender through MoneyMutual, that lender charges a fee in exchange for lending money. Read the terms carefully to make sure you understand how much it costs to borrow.

How long does it take to use MoneyMutual?

It takes about five minutes to complete the MoneyMutual online form. If you have used MoneyMutual before and are a loyal customer, it takes even less time.

Once you fill in the online form and select an offer, you can get the money in your account in just 24 hours.

How do MoneyMutual lenders work?

MoneyMutual works with over 90 lenders to find the best deal for your unique needs. Each lender considers your personal information and financial data provided by you to ensure an optimal match.

Here’s how lenders look at your information, according to MoneyMutual:

- Lenders automatically review your information after you submit an application through the website

- Each lender follows the previously established requirements to make a decision

- If a lender decides that they want to lend you money, you will be redirected to their website, where you can review the terms of the loan and accept the loan.

- Lenders may also contact you to verify your personal information, confirm your bank account number and finalize the loan.

That’s it. Like other payday lenders, payday lenders with MoneyMutual are legally required to disclose all fees up front. The law also prevents them from charging excessive annual interest rates. Check all fees and charges in advance to avoid any surprises.

What’s the catch?

There is no “trap” in using MoneyMutual. The website genuinely connects you with payday lenders and short-term lenders in your area who can lend you money as quickly as possible.

Be sure to read the terms and conditions on your lender’s website to make sure you understand the terms of the contract. Although MoneyMutual is a free service, each lender has its own terms and conditions.

MoneyMutual Reviews: What Customers Are Saying

The payday loan industry is filled with shady companies. However, MoneyMutual is one of the best known and oldest companies in the industry. With celebrity endorsements from Montel Williams and over a decade of experience, MoneyMutual has helped over 2 million people access the money they need.

Here are some of the MoneyMutual reviews from verified customers online:

Most customers agree that MoneyMutual works as advertised to provide them with sources of short-term funding, bringing borrowers and lenders together in a transparent marketplace.

Customers love MoneyMutual because of the transparent rates and lending system, which makes it easy to see the best deal from each lender

Many use MoneyMutual after seeing the advertisements on television, finding that MoneyMutual lives up to its claims of providing efficient loans to people in need.

Some customers even praise MoneyMutual’s customer service, which is not the strong point of most payday loan companies.

Negative reviews tend to leave bad reviews because of bad interactions with the third-party lender, not because of bad interactions with MoneyMutual; some lenders have high interest rates and fees, for example, which may surprise customers who don’t read the terms and conditions

MoneyMutual Requirements

To borrow money through MoneyMutualyou must meet the following conditions:

- Be at least 18 years old

- Have at least $800 per month of verifiable income

- Have a checking account

Some lenders require additional items from borrowers, such as an SSN. Others, however, require no additional information or data.

About MoneyMutual

MoneyMutual is a free online resource based in Las Vegas, Nevada. The company is not a lender: it partners with lenders to help people find payday loans for their short-term financial needs.

Between 2010 and 2018, Montel Williams was the spokesperson for MoneyMutual.

You can contact MoneyMutual via:

- E-mail: [email protected]

- Call:

844-276-2063

Last word

40% of Americans would not be able to come up with $400 in an emergency, according to the Economic Well-Being of US Households report.

To get a fast, easy and affordable payday loan from a trusted lender, visit MoneyMutual.com today. The website connects you with dozens of lenders in your area to ensure you get the best deal, and you can get $200 to $5,000 deposited into your account in as little as 24 hours.

To learn more about MoneyMutual or to apply online today, visit the official website at MoneyMutual.com.

Affiliate Disclosure:

Links in this product review may result in a small commission if you choose to purchase the recommended product at no additional cost to you. This serves to support our research and writing team. Know that we only recommend high quality products.

Warning:

Please understand that any advice or guidance revealed here does not even remotely replace sound medical or financial advice from a licensed healthcare provider or certified financial advisor. Be sure to consult a professional doctor or financial advisor before making any purchasing decisions if you are using any medications or have any concerns from the review details shared above. Individual results may vary as statements regarding these products have not been evaluated by the Food and Drug Administration or Health Canada. The effectiveness of these products has not been confirmed by the FDA or Health Canada approved research. These products are not intended to diagnose, treat, cure, or prevent any disease or to provide any type of enrichment program.

Gallery

The news and editorial team at Sound Publishing, Inc. played no role in the preparation of this post. The views and opinions expressed in this sponsored post are those of the advertiser and do not reflect those of Sound Publishing, Inc.

Sound Publishing, Inc. accepts no responsibility for any loss or damage caused by the use of any product, and we do not endorse any product displayed on our Marketplace.

]]> Most of the time, people get a payday loan because they can’t get quick financing anywhere else. Unfortunately, the financial situation can worsen if the borrower is unable to repay what he owes. Depending on how long it’s been since you received the loan, the lender could threaten to take legal action against you and […]]]>

Most of the time, people get a payday loan because they can’t get quick financing anywhere else. Unfortunately, the financial situation can worsen if the borrower is unable to repay what he owes. Depending on how long it’s been since you received the loan, the lender could threaten to take legal action against you and […]]]>

Most of the time, people get a payday loan because they can’t get quick financing anywhere else. Unfortunately, the financial situation can worsen if the borrower is unable to repay what he owes.

Depending on how long it’s been since you received the loan, the lender could threaten to take legal action against you and garnish your wages. Borrowers in this situation have options that could potentially help them.

What can happen if you don’t repay a payday loan

While every situation may have differences, there are typical consequences when you don’t repay a payday loan on time.

Withdrawals from your bank account

Most lenders repeatedly attempt to withdraw the funds from your bank account, as permitted by the terms of the loan agreement. If transactions are declined by your bank due to insufficient funds, the lender may initiate withdrawals for lower amounts.

Even if the lender collects some of the outstanding balance using this method, you could still face financial hardship if further banking transactions are declined. Plus, bank charges could add up and cost you several hundred dollars in a short period of time.

Collection agencies get involved

You can expect the lender to initiate collection efforts, including repeated calls and letters demanding payment, while continually trying to write your account. The lender could also sell your debt to a collection agency or hire a lawyer to collect what is owed to you.

You may be able to stop collection actions by asking the lender for an extension. Some states have laws that require payday lenders to grant extended payment plans to borrowers upon request. Remember that these extensions often come with additional fees and interest.

Declining credit score

The lender could also report the delinquent account to the credit bureaus once it is turned over to a collection agency. Your credit score will likely drop and the negative mark will remain on your credit report for up to seven years. Therefore, you may find it difficult to obtain competitive financing offers in the future.

You can take steps to start rebuilding your credit score after defaulting on a payday loan. First, review your credit report to identify any other delinquent accounts and update it, as payment history is the most important part of your credit score. You also want to find errors and challenge them quickly.

Also adjust your spending plan to free up funds that you can use to start paying off credit card debt in the near future. You want to do this to lower your credit utilization rate, or the amount of revolving credit you use, because it makes up 30% of your credit score.

Most importantly, keep an eye on your credit report and build responsible debt management habits over time to give your credit score the best chance of getting stronger over time.

Negotiations with the lender

It’s much cheaper for the lender to collect than to sue you, and selling the balance to a debt collector for pennies on the dollar means the lender will only get a small percentage of what’s owed to them. .

Both circumstances give you the leverage to eventually settle payday loan debt for a fraction of the outstanding balance. Offer an amount you can afford to pay in one lump sum and mention your intention to file for bankruptcy if the lender won’t budge. The lender may be willing to compromise with you since bankruptcy means they may not be able to collect.

Lender lawsuit

If the lender takes you to court, the onus is on them to prove that you owe the debt. Simply ask that they provide the documentation or agreement you signed when taking out the loan. If the debt collector cannot provide this information, the judge will likely dismiss the case. But if the lender proves that you are indebted and obtains a judgment from the courts, you could be ordered to pay or have your wages garnished.

Quick note: If the lender is threatening to throw you in jail, quickly contact your state attorney general’s office to file a complaint.

How to get the money to pay off a payday loan

Instead of ignoring a delinquent payday loan and ruining your credit, consider these options for paying off debt:

- Apply for a peer-to-peer lending. If your credit score is low, a peer-to-peer loan is worth considering. You will find these loan products in online lending marketplaces that connect potential borrowers with investors looking to lend you funds in exchange for a return. You can usually compare multiple loans with one application, and you’ll usually need to provide proof of income or assets to be approved.

- Obtain a debt consolidation loan. A debt consolidation loan allows you to combine high-interest debt into a single loan product with a lower interest rate. Most debt consolidation loans have a fixed interest rate and you will make equal monthly payments over a set period. The most competitive loan terms are reserved for borrowers with good or excellent credit. Even with less than optimal credit scores, your rate could be lower than what you received with the payday loan.

- Consider a short-term emergency loan. Credit unions and some community banks typically offer short-term emergency loans as alternatives to payday loans. They are usually available with slightly lower interest rates and for small dollar amounts, capped at $1,000, and may not require a credit check for approval.

- Register in a debt management plan (DMP). It should be used as a last resort if you have exhausted all your options. DMPs are available through non-profit agencies. A credit counselor will contact the payday lender on your behalf to negotiate a modified repayment plan that suits your budget. You’ll pay the loan principal balance in full, but the downside is that signing up for a DMP could cause other creditors to close your credit card accounts, causing further credit damage.

You can also try talking to friends and family or looking for ways to adjust your finances to cover expenses such as temporarily canceling streaming subscriptions, switching to a lower food budget.

When you’re low on cash between paychecks or have an unexpected financial emergency, a payday loan can be a tempting option to help you make ends meet or access cash quickly. However, these short-term loans, which are usually due on the day of your next payday, are extremely risky. They come with very high interest […]]]>

When you’re low on cash between paychecks or have an unexpected financial emergency, a payday loan can be a tempting option to help you make ends meet or access cash quickly. However, these short-term loans, which are usually due on the day of your next payday, are extremely risky. They come with very high interest […]]]>

When you’re low on cash between paychecks or have an unexpected financial emergency, a payday loan can be a tempting option to help you make ends meet or access cash quickly. However, these short-term loans, which are usually due on the day of your next payday, are extremely risky. They come with very high interest rates and other charges. The interest rate on payday loans in the United States ranges from 154% to 664% or more.

Equally troubling, payday loans are often marketed to those who can least afford them, i.e. people who earn less than $40,000 a year. Although this type of loan is marketed as a short-term loan, payday loans can create a cycle of debt that is difficult to break free from.

What is a personal loan?

A payday loan is usually a short-term loan, lasting two to four weeks, that does not require collateral to be obtained. These types of loans are generally supposed to be repaid in a single payment with your next paycheck, when you receive Social Security income, or when you receive a pension payment.

In the majority of cases, payday loans are granted for relatively small amounts, often $500 or less, with the average borrower getting a payday loan of around $375. In some cases, payday loans can be made for larger amounts.

To obtain a payday loan, borrowers are asked to write a personal check for the amount of debt plus finance charges and fees. If the loan is not repaid on time, the lender will deposit the check to recover their funds. Some lenders may request authorization to electronically deduct the funds from your bank account instead of requiring you to provide a personal check.

Payday loans generally do not involve credit checks, and your ability to repay debt while continuing to pay your daily expenses is generally not considered part of the application process.

Who usually takes out a personal loan?

Payday loans are most often sought out by those with ongoing cash flow issues, as opposed to borrowers who find themselves facing a financial emergency. A study of payday loans conducted by Pew Charitable Trusts found that the vast majority of payday loan users, 69%, first took out this type of loan to cover recurring expenses such as utility bills. utilities, rent, mortgages, student loan payments or credit cards. bills. Only 16% of borrowers use payday loans for unexpected expenses.

These types of loans are also widely used by people living in neighborhoods and communities that are underserved by traditional banks or by those who do not have a bank account with a major financial institution. There are approximately 23,000 payday lenders across the country, many of which are located in storefronts or operate online.

What are the risks of personal loans?

Due to the many risks associated with payday loans, they are often considered predatory loans.

For starters, payday loans often come with astronomical interest rates. Those who take out such loans have to pay between $10 and $30 for every $100 borrowed. A typical payday loan with a two-week repayment term and a fee of $15 per $100 equates to an APR of nearly 400%.

Many payday lenders also offer rollovers or renewals, which allow you to simply pay the cost of borrowing the money on the loan’s due date and extend the balance owing for a longer period. It can be a slippery slope that has borrowers quickly getting in over their heads with accrued fees and interest. According to the Consumer Financial Protection Bureau, borrowers default on up to one in five payday loans.

Further, since payday loans do not consider the full financial situation of the applicant, including their ability to meet other financial obligations and living expenses while repaying the payday loan, this type of loan often leaves borrowers in a vicious cycle of debt.

Are payday loans really worth it?

With their high interest rates and fees, a payday loan is rarely a good idea. The fees alone cost Americans $4 billion a year. Because the costs associated with these loans are so high, borrowers often struggle to repay them and take on more debt, so it’s a good idea to carefully consider your options before taking out a payday loan.

However, if you are in dire need or need cash quickly and you are absolutely certain that you can repay the loan with your next paycheck, a payday loan may be a good idea. These loans may also be worth considering if you have no other financial options or have poor credit and would not qualify for a traditional loan.

Alternatives to payday loans

Before taking on the significant financial risks associated with a payday loan, consider other alternatives that may be less expensive. Some of the options to consider include:

- Personal loan: For those with good credit, a personal loan can be a safer and more cost-effective borrowing option. Plus, if you need cash fast, there are online lenders who can provide personal loan funds in as little as a day or two.

- Borrowing money from family or friends: Payday loans should be a last resort. If you have family or friends who are willing to help you, it may be better to borrow money from loved ones than from a predatory lender.

- Home Equity Loan: Tapping into the equity in your home will give you a much more competitive interest rate than a payday loan. Home equity loans are a popular way to access cash to consolidate debt or pay for other large or unexpected expenses. However, to access the equity in your home, you will need to meet certain requirements, including having a good credit rating, a stable income, and a debt-to-equity ratio of 43% or less.

It’s no secret that we have a huge debt crisis in the United States. Americans owe lenders trillions of dollars, and that number is growing every day. People struggle to make ends meet with the funds they have before they even have to pay off their debts. And when the middle of the month arrives […]]]>

It’s no secret that we have a huge debt crisis in the United States. Americans owe lenders trillions of dollars, and that number is growing every day. People struggle to make ends meet with the funds they have before they even have to pay off their debts. And when the middle of the month arrives […]]]>

It’s no secret that we have a huge debt crisis in the United States. Americans owe lenders trillions of dollars, and that number is growing every day. People struggle to make ends meet with the funds they have before they even have to pay off their debts. And when the middle of the month arrives and they find themselves without cash, a simple solution is offered to them: the personal loan.

Payday loans are short-term loans given to you throughout the month until your next payday. The idea is that you repay them as soon as you get paid. However, they are often the catalyst for additional debt with crippling interest ratesand are known as predatory lending.

For this reason, it is worth avoiding payday loans at almost any cost. Yes, they can provide temporary relief, but they are much more likely to land you in much worse trouble. It is important to know that there are alternatives.

The alternatives can be hard to digest, whether because they involve swallowing your pride or because they tire you out in some other way. However, they must absolutely be considered before resorting to a payday loan.

Non-profit organizations and charities

Before you conclude that you don’t need a charity and you won’t benefit from it, stop for a moment. The reality is that charities are in the best position to help those who are still somewhat creditworthy. When they give money to people without any other form of income, that money earns nothing. However, when you borrow money from a nonprofit or charity, you agree to repay it.

Different charities and nonprofits have different requirements when asking for help. They may ask to see your payslips and other personal information. Consider that when you get back on your feet, you will be motivated to help this charity. Turning to them for help gives you the best chance of helping yourself and helping them down the road.

401(k) Loans

You can take out a loan on your 401(k) if you have one from your employer. 401(k) loans are not the same as premature withdrawals from your 401(k). Instead, they work like any other loan, giving you money up front that you can repay over a term of up to five years.

401(k) loans are interest-bearing, although the rates are low. However, they do not impact your credit score and you do not need a good credit score to apply for them.

Loans to credit unions

If you are a credit union member in good standing, you can apply for a loan from the credit union. They will take your credit score into account, but place more weight on your relationship with the credit union. They can offer alternative payday loans, which have a maximum interest rate of 28%.

These credit union loans will always be expensive and can negatively impact your credit score. However, you will get better terms than you would from a payday lender.

Family loans

Going to a family member or friend to apply for a loan is difficult. We all have a lot of self-esteem issues in our family and social circles. Admitting that you need help will force you to swallow your pride. You will also be extremely aware of the difficult position you could put them in.

However, it is a better way to go than payday loans and there are ways to do it that provide some relief. Write a contract rather than just asking them for a deposit into your account. Treat their loan as you would any other loan, committing to repay them according to specific guidelines.

By doing so, you are showing them that they are not just giving you money. This will put them at ease and also contribute to your pride. Don’t fall into the trap of promising more than you can guarantee, as this will only make things worse in the long run. Be as honest as possible and remember that the reason you might ask them is because they know you would do the same for them.

Pawn shop

Pledging items is one of the oldest forms of short-term lending. When you go to a pawn shop, you are essentially taking out a loan with property as collateral. If you don’t repay the loan on time, they take possession of that property and sell it. Pawnshops are still a viable way to get some quick cash, and if you know you’ll be able to repay the owner, you’re not risking too much.

There are significant drawbacksof course, including the lack of regulation and the possibility that you end up losing a precious or sentimental possession.

There are other alternatives for getting quick cash that are better than payday loans. The main takeaway should be that payday loans are a terrible last resort. When you get a payday loan, you’ll probably end up having to get one of the alternatives above, only at a later date and in a much more difficult situation.

This article does not necessarily reflect the views of the editors or management of EconoTimes

A ballot initiative to restrict interest rates charged by payday lenders has removed one final procedural hurdle, with supporters set to collect signatures that could put it on the ballot in November. On Friday, the Michigan Board of State Solicitors approved petition language for the Michiganders for Fair Loans ballot initiative. As noted in the […]]]>

A ballot initiative to restrict interest rates charged by payday lenders has removed one final procedural hurdle, with supporters set to collect signatures that could put it on the ballot in November. On Friday, the Michigan Board of State Solicitors approved petition language for the Michiganders for Fair Loans ballot initiative. As noted in the […]]]>

A ballot initiative to restrict interest rates charged by payday lenders has removed one final procedural hurdle, with supporters set to collect signatures that could put it on the ballot in November.

On Friday, the Michigan Board of State Solicitors approved petition language for the Michiganders for Fair Loans ballot initiative. As noted in the petition, the proposal would cap the annual percentage rate (APR) on payday loans at 36% and empower Michigan’s attorney general to sue lenders who exceed that rate. The group says payday lenders are currently allowed to charge “interest rates and fees equivalent to an annual percentage rate of 340% or more.”

Campaign spokesman Josh Hovey called the charging of these rates “outrageous” and said that with the canvassers’ approval, they will soon begin collecting petitions to reform this “predatory lending practice”. The group says its initiative is modeled on similar legislation in 19 other states, including Nebraska, which capped payday loan rates at 36% APR in 2020. with almost 83% support.

However, business interest groups say the measure will not provide protection against predatory payday lending, but rather penalize lenders who play by the rules.

Fred Wszolek is a Republican strategist and co-founder of Lansing-based Strategy Works. In an interview with Michigan advance On Friday, he said the initiative “effectively bans the industry under the guise of a proposal that simply caps the interest rate.”

Wszolek says the industry is already tightly regulated and called APR a “dumb statistic” to use as a metric.

“It’s a great kind of apple-to-apple comparison of this 30-year loan to this 30-year loan, but when you’re talking about a two-week loan, to translate the interest rate and the fees into a rate annual percentage, that’s a stupid math,” he said. “I mean, it’s just a meaningless number. If you think of the bad check fee as a one-week loan for you because they covered your check, then the APR on the $25 NSF check fee is about 1,200%.

Wszolek says that due to the short-term nature of payday loans, limiting the APR to 36% will not provide the profit margin needed for these lenders to operate their storefronts, meet mandatory compliance regulations and write off numbers. loans that will inevitably go unpaid.

He also says that if the initiative is approved, it will only affect state-regulated operations, not overseas-based online lenders or tribal-owned payday lenders.

Fred Wszolek is a Republican strategist and co-founder of Lansing-based Strategy Works. In an interview with Michigan Advance on Friday, he said the initiative “effectively bans the industry under the guise of a proposal that simply caps the interest rate.”

“I mean, they’re not getting rid of the regulation of this industry, from a consumer perspective, because the consumer can’t tell the difference between all the websites. I mean, you can’t say you’re dealing with a tribe-run payday loan operation. That’s beyond the reach of Michigan law. You can’t say you’re really dealing with a company that’s in the Netherlands Antilles” or has a “PO box somewhere in the Caribbean”.

Hovey responded to those criticisms in an interview Friday with the Michigan Advance, acknowledging that while the ballot proposal only applies to state-licensed lenders, the fees charged by those lenders are equivalent to three-digit interest rates.

“I can’t imagine the average Michigander would consider a 300% interest rate ‘legitimate’ or just because legitimate lenders don’t do that stuff,” Hovey said.

As for concerns that small dollar loans won’t be available, he says there are credit unions that offer payday loan alternatives.

“The President of Isabella Community Credit Union even testified before the House Regulatory Reform Committee this week that they are able to offer small loans in as little as 15 minutes that have a maximum APR of 23 % that can be repaid over 11 months. period,” Hovey said.

Groups supporting the ballot initiative include the Michigan League for Public Policy, Habitat for Humanity of Michigan, and the Michigan Association of United Ways. Sandra Pearson, president of Habitat for Humanity Michigan, formerly told the Associated Press that even though payday lenders offer short-term loans as a quick fix, they often leave borrowers in worse financial shape than before.

Michiganders for Fair Lending expects to begin collecting the 340,047 valid signatures required to place the measure on the November ballot within the next two weeks.

Get morning headlines delivered to your inbox

A statewide database to track short-term payday loans, which was supposed to be operational in July 2020, is finally operational a year and a half later. It took until February 1 this year for the system to go live, a year after lawmakers approved regulations governing the database on December 28, 2020. After failing to […]]]>

A statewide database to track short-term payday loans, which was supposed to be operational in July 2020, is finally operational a year and a half later. It took until February 1 this year for the system to go live, a year after lawmakers approved regulations governing the database on December 28, 2020. After failing to […]]]>

A statewide database to track short-term payday loans, which was supposed to be operational in July 2020, is finally operational a year and a half later.

It took until February 1 this year for the system to go live, a year after lawmakers approved regulations governing the database on December 28, 2020.

After failing to grant a hearing for legislation in 2019 that proposed to cap percentage rates for payday loans, which can go up to 600% in Nevada, lawmakers instead passed Senate Bill 201, who authorized a database to ensure that loan companies do not lend to borrowers. who cannot afford to repay.

In an email, Teri Williams, spokesperson for the Department of Trade and Industry, said on Monday that the long delay between the passage of the bill and its implementation is due to a mixture of problems, including the pandemic.

“The delay was primarily due to operational disruptions and technological challenges due to the pandemic, which impacted the process and timing of organizing regulatory workshops, the LCB (Legislative Counsel Bureau) review, the RFP process and the actual development and testing of the database prior to implementation. ,” she said.

Nevada’s Financial Institutions Division, which held virtual meetings regarding database development during the pandemic, encountered technical difficulties along the way that caused meetings to be postponed and rescheduled, it said. she adds.

“The initial workshop for the database was scheduled and the meeting was oversubscribed and people couldn’t get into the meeting so they had to cancel it and reschedule it for 30 days as required by law. “Williams said. “Part of the delay can also be attributed to the vacancy of the divisional commissioner position and the subsequent hiring of a permanent commissioner to guide settlements through the process.”

Consumer rights advocates and legal groups have long urged Nevada officials to take more action to curb predatory practices in the payday loan industry. Even though they argued that the state should do more, they supported the creation of the database.

The initial regulations governing the database were finalized in November 2020 and included provisions to prevent customers from taking out multiple loans exceeding 25% of their income.

Lawmakers approved the proposal 7-5 in a party-line vote at a December 2020 meeting of the Legislative Committee, which approves regulations for state agencies.

Mary Young, deputy commissioner of the Nevada Division of Financial Institutions, was asked during the hearing about the expected timeline for the establishment and operation of the database.

She was unable to provide lawmakers with a specific timeline.

Ahead of the Legislative Committee’s vote in favor of the regulations in 2020, former state senator Julia Ratti said there was an urgent need to get the database up and running as quickly as possible.

“This is a consumer protection bill passed by the Legislative Assembly that we need to put in place as soon as possible,” she said. “I already hear about my constituents getting into trouble. The idea here is that there is some responsibility in not letting individuals jump from place to place and rack up more debt than they can ever repay and be buried in that debt.

Republicans who voted against the settlement feared the proposal would go beyond the scope of the legislation.

The vote also drew negative reactions from representatives of the payday loan industry, who had lamented the process since Nevada’s Financial Institutions Division began discussing database regulation earlier in the year.

MP Maggie Carlton, who also voted in favor of the settlement, said the database was a good way to collect data that would give better insight into the practices of payday lenders.

“I think it’s a good step forward just knowing what issues might exist with this industry and being able to have a factual conversation about the behavior of the industry and who is accessing it for these short-term loans. term,” she said. “There’s nothing here about trying to get rid of the industry. We know it’s going to be there for a while. We just want to know what’s really going on. If you can’t you can’t measure it, you can’t monitor it and you can’t regulate it.

Rachelle* was 17 and a bit short on cash when she borrowed $60 early last year from online payday lender Cigno.

Key points:

- $60 loan repayments soared to $800 debt for teen who borrowed money

- ASIC plans to use its powers of intervention to ban loan models handled by Cigno

- Consumer advocates say customers are trapped in ‘debt spirals’

Since then, her quick cash fix has turned into a current debt of $800 which she admits to struggling to repay.

“In just two clicks, it was in my bank,” said Rachelle, who uses a pseudonym to protect her identity.

“But that doesn’t tell you how much it’s going to cost you. It doesn’t tell you how much the late fee is. It doesn’t tell you anything.

“Reimbursements just keep going up and up.”

The 18-year-old, from Palm Island in North Queensland, is among hundreds of borrowers caught off guard by the controversial loan scheme which consumer advocates describe as “one of the of the most harmful individual credit on the market”.

“They only received a small amount but are now paying 10 times more.”

“Rapid and harmful debt spirals”

Cigno is a Gold Coast company that processes same day cash loans and whose director and CEO is former super rugby player Mark Swanepoel.

Rachelle said Cigno uses Facebook ads to target customers like her.

His story is all too common for consumer advocates, who are calling on the Australian Securities and Investments Commission (ASIC) to ban Cigno-processed lending models.

In 2020, ASIC filed a lawsuit against Cigno and its supplier BHF Solutions, alleging they violated the nation’s Consumer Credit Protection Act.

The Federal Court dismissed ASIC’s claim in June 2021, and the full Federal Court has since reserved its decision on ASIC’s appeal.

Separately, ASIC has sought public input to help it decide whether to exercise product intervention powers that would prohibit Cigno’s short-term credit model.

In a joint submission to ASIC, the Consumer Action Law Centre, Financial Rights Legal Centre, Indigenous Consumer Assistance Network (ICAN), Victorian Aboriginal Legal Service and WEjustice said the loans are pushing people into spirals of rapid and more detrimental indebtedness.

“Virtually every consumer we saw who took out such a loan suffered significant harm as a result,” their brief states.

“The fact that an unregulated fringe lending program appears more often in the records than any other major bank or payday lender is a telling indicator of the harm these loans cause in the community.”

quick money

Cigno offers loans of up to $1,000 which can be accelerated if the customer wants the money immediately.

The company told the ABC that before accepting a loan, customers acknowledged that they were over 18 and of sound mind and judgment to make their own financial decisions.

Rachelle, however, said no proof was required when she checked the terms and conditions box.

ICAN COO Jillian Williams said the blame lies with Cigno.

“Consumer law protections in Australia make it very clear that the onus is on the creditor to assess a person’s ability to repay a loan,” Ms Williams said.

“Unfortunately with Cigno… they operate outside of those protections.

“We see a $5.95 account maintenance fee, a $50 rejection letter fee, a $79 second rejection letter fee, the $49 rejection fee itself, a collection of $50 tracking fee.”

“Two Sides to Every Story”

In Cigno’s own submission to ASIC, general manager Mark Swanepoel said “there are two sides to every story.”

“ASIC and the mainstream media say we prey on the vulnerable and less sophisticated, charging all our customers exorbitant fees and exploiting the very people we claim to be helping,” Swanepoel wrote.

“The reality is that ASIC, the government regulator, has formed an opinion based on a very small percentage of our customers.”

Mr Swanepoel also accused ASIC of distorting the information.

“We are fighting a large group of hypocrites – leeches [sic] of society that steal more and more freedom and choice from ordinary people behind the veil of good intentions,” he writes.

In another statement to the ABC, Cigno said a fee was added [to customers’ loans] in exchange for not fulfilling the commitment.

“Cigno is extremely transparent about the cost of using our services, as it has always been explained in the application process,” said a claims manager.

“Additionally, we regularly send payment reminders via email and SMS two days before a payment is due…despite this, some of them are only trying to contact us [sic] recently.”

ASIC will seek approval from Federal Treasurer Josh Frydenberg before deciding whether to exercise its product intervention powers again.

life on hold

Rachelle said her credit history hasn’t recovered since she borrowed from Cigno and it’s affecting her future.

“You really want to pay it [back]but you don’t want to pay that much,” she said.

“I got pushed away from a lot of places, like car loans.

“Only from a stupid $60, Cigno got me into debt. I can’t get anything more.”

*Name changed to protect identity

In 2019, Shelly-Ann Allan’s bank refused to lend her the money she needed to pay for her father’s funeral, so she had to turn to a payday loan company. But what she didn’t take into account was the death of her stepfather shortly afterwards. She had to take out another payday loan in addition to […]]]>

In 2019, Shelly-Ann Allan’s bank refused to lend her the money she needed to pay for her father’s funeral, so she had to turn to a payday loan company. But what she didn’t take into account was the death of her stepfather shortly afterwards. She had to take out another payday loan in addition to […]]]>

In 2019, Shelly-Ann Allan’s bank refused to lend her the money she needed to pay for her father’s funeral, so she had to turn to a payday loan company.

But what she didn’t take into account was the death of her stepfather shortly afterwards. She had to take out another payday loan in addition to the one that still had a balance of $1,500.

“Interest rates [have] built and built on me, and that’s where it’s affecting me right now,” said Allan, who lives near Jane and Finch, an area of the city that has a disproportionate number of payday loan companies.

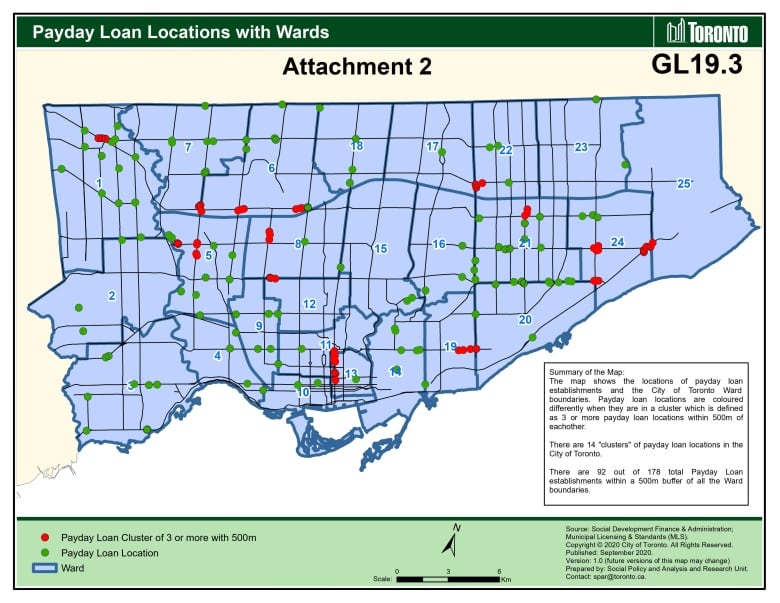

Critics say the concentration of these companies in low-income communities helps perpetuate the cycle of poverty. That’s why Toronto City Council is discussing a recommendation from its housing and planning committee this week that would ban new payday lending establishments from locating within 500 meters of social services offices, public housing, liquor stores, casinos and pawnshops.

According to Allan’s contract with payday loan company easyfinancial, her cumulative interest rate is now 47% and she now owes $24,000. She says people where she lives need more than just zoning restrictions to restrict payday lenders, they also need financial institutions that will lend them money at reasonable interest rates.

“People like me…the bank wouldn’t look at me to lend, because they said I wouldn’t be able to pay that money back,” Allan said.

Zoning boundaries

Currently, lenders in Ontario cannot charge more than $15 in interest for every $100 borrowed.

Despite this, Andreas Park, a professor of finance at the University of Toronto, says annual percentage rates can reach over 400% for short-term payday loans, and additional interest can be charged if the loan fails. is not repaid at the end of the term, according to the Payday Loans Act.

A 2021 report by city staff indicates that the zoning restrictions would only apply to new establishments and could not apply retroactively to existing establishments.

In 2018, the city capped the number of payday loan licenses and locations. The city says this contributed to a decrease of more than 20% of these establishments, from 212 to 165 as of January 26. But a new supplementary report released days before the city council meeting this week shows that the remaining movements of payday outlets have been limited, with only three movements since the city introduced these restrictions.

Staff recommended finding “improvements in consumer protection and access to low-cost financial services” as a way to regulate the industry.

Com. Anthony Perruzza, who represents Ward 7, Humber River-Black Creek, says it’s all part of the city’s Poverty Reduction Initiative.

“But that plan is still being worked on, and there are still a few years to work out.”

Park says zoning restrictions against businesses are limited in their ability to get to the heart of the problem.

“It’s quite striking that these payday lenders are so prevalent in poor neighborhoods and there isn’t a better service on offer,” said Park, who agrees that vulnerable groups need better access to loans at reasonable interest rates.

“Why haven’t we put systems in place that help them overcome some of the challenges they face? »

ACORN Toronto, an advocacy organization for low- and middle-income groups, says that while it welcomes the reduction in payday loan points, the city should follow Ottawa and Hamilton, who have already put restrictions in place. zoning.

“The more frequently residents see these businesses, the more likely they are to consider accessing the high compound interest loans,” wrote Donna Borden, director of East York ACORN, in a letter to the city.

“We think it’s not about planning logic, but about equity, human rights and fair banking.”

The City needs federal and provincial help

The last time the council discussed this topic was in December 2020, where it made numerous requests to the federal government to strengthen enforcement against predatory lending and to the province to provide options for cheaper loans to consumers.

The Ontario government told CBC News it is considering feedback from a 2021 consultation with stakeholders and the public on ways to address the issue.

Additionally, the Federal Department of Finance said in an emailed statement that the government is considering cracking down on predatory lenders by lowering the criminal interest rate, which is now set at 60%. However, payday lenders are exempt from this provision in provinces that have their own financial regulatory system, such as Ontario.

Perruzza says these lenders are predatory and need to be regulated at all levels of government, especially in the wake of COVID-19.

“We really need to impress upon the federal and provincial governments that this is a huge problem and that they need to use their legislative tools at their disposal.”

Sponsored content A small loan is a type of unsecured loan. This means you don’t have to post collateral in case you don’t repay your existing loan. The lender does not have the right to confiscate your property if you take out a small loan and do not repay it on time. Nevertheless, there are […]]]>

Sponsored content A small loan is a type of unsecured loan. This means you don’t have to post collateral in case you don’t repay your existing loan. The lender does not have the right to confiscate your property if you take out a small loan and do not repay it on time. Nevertheless, there are […]]]>

Sponsored content

A small loan is a type of unsecured loan. This means you don’t have to post collateral in case you don’t repay your existing loan. The lender does not have the right to confiscate your property if you take out a small loan and do not repay it on time. Nevertheless, there are negative consequences: your credit rating will drop and your small loan could be declared in default.

Small loans require collateral such as your home in the case of a mortgage or your car in the case of a car loan. Small loans use your credit score and credit history to determine if you qualify.

Small loans generally do not have strict requirements. Instead, you can use a small loan for almost anything as long as it initially meets the conditions set out in your loan agreement, you can also learn more about MoneyZap, one of the organizations that offer small loans. Small loans are given as a lump sum and you make monthly payments until your loan is paid off in full. As long as you make your monthly payments, you continue to spend what you want within your limit.

Reasons for taking out a small loan

Small loans or personal loans can be used for almost all your needs within reason and in accordance with the terms of your loan. You cannot use the money for anything illegal. In most cases, for the cost of post-secondary education. Here are some good reasons to get a small loan:

Emergency cash assistance

If you need money right now to cover bills, urgent expenses, or anything else that needs immediate attention, you can take out a small loan. Most lenders provide online applications that let you know if you’ve been approved within minutes. You can get financing the same day or within a few business days, depending on your lender.

You can use the loan to cover emergencies such as:

- Payment of late payments for housing and utilities;

- Medical bills;

- Unscheduled car repairs;

- Funeral expenses.

A small unsecured loan is a good alternative to a payday loan. Payday loans are short-term, high-interest loans that usually have to be repaid when you get your next paycheque. Typically, you won’t need to go through a credit check and you can get financing right away. But payday loans can do more harm than good. Interest rates can reach 400%, and many borrowers do not have the funds to pay off the loan in full as quickly as payday loans require.

Home improvement and renovation

If you own a private home, you can take out a small loan to renovate or modernize it. You can also take out a consumer loan. Home loans and lines of credit are perfect for tackling real estate projects. They are secure and use your home as collateral. If you don’t want to risk losing your home if payments are delayed, a small loan is a reliable substitute in this case. Along with that, getting a small loan can be faster compared to a home equity loan.

Moving expenses

If you move near your current place of residence, you may not have to cover major expenses. If you’re moving out of state, you may need extra money to pay for travel expenses with a personal or home loan. Moving means covering the cost of packing your belongings, possibly hiring movers, and transporting your belongings to a new location. A personal loan will also help fund the process of finding a new home. For example, if you find an apartment, you may have to pay the first month, the last month and a deposit. You may also need money to furnish your new home.

Debt Consolidation

Americans owe $1 trillion on their credit cards. Although some of them include purchases made by people, they include interest and fees. It all adds up and can deter many consumers from paying off their credit card debt. A personal loan can be used as debt consolidation, especially when it comes to credit card debt. This is also a popular reason why people take out a personal loan.

Small loans charge low interest rates compared to credit cards, especially if you have a good credit rating. The best loans charge an interest rate of only 4% lower than the double digit interest rates charged by most credit cards. You can take out a loan, pay off your credit card balance, and then make a one-time payment to your new loan department staff.

Wedding expenses

Financial experts do not recommend borrowing money to pay for a wedding. Instead, consider reducing your wants to stay within your acceptable budget. If you need to borrow money, you have several options such as credit cards and personal loans. Credit cards have higher interest rates than personal loans. There may be even higher interest rates and fees when dispensing cash by credit card. A small consumer loan is a less expensive borrowing option if you need money to cover major expenses.

Total amount of loan overpayment

Do not complicate your life with independent calculations, multiplying interest by the amount of the loan, adding up commissions, etc. Ask the bank or MFO for an approximate payment schedule from which it is easy to calculate the amount of the overpayment. Banks do not always have their own operational offices in your city to receive loan repayments. Thus, be sure to specify the method of payment through the terminals. Add the commission to the overpayment amount on the schedule. You will receive the absolute amount of the overpayment in dollars for your convenience. You can divide it by the loan amount and get the overpayment in %.

Keep in mind that the actual payment schedule when obtaining a small loan may differ from that provided to you at the pre-consultation stage. Therefore, before signing the loan agreement, check the final payment schedule with the original and the offer competitors. Feel free to get up and go if the loan terms and payment schedule differ from the original ones that suit you.