Best Cash Advance Apps | Top 5 Payday Loan Consolidation Apps With Bad Credit

Cash advance apps are advance payday providers that eligible borrowers can use to connect with proper lenders who would approve their request by incurring high-interest credit based on one’s income. The best cash advance apps usually process within a day or two and therefore it is a great method to fulfill one’s financial needs at any moment.

#1 Best Cash Advance App – Viva Payday Loans

5 Best Cash Advance Apps in 2021 – Quick-Pick

Following are some of the alternatives that may help you to get guaranteed loans with no credit check.

- Viva Payday Loans – Best for very quick cash advances

- Credit Clock – Best for lower loan amounts ($100 – $500)

- Money Lender Squad – Best for wide range of lender options

- Very Merry Loans – Best for accepting those with low credit scores

- Heart Paydays – Best for high approval rates

How do I get started with the Best Cash Advance App? Quick 4-step guide:

A payday loan is a high-interest, short-term, payday loan consolidation”}” data-sheets-userformat=”{“2″:513,”3”:{“1″:0},”12″:0}”>payday loan consolidation, dependent on your earnings. With websites like VivaPaydayLoans.com, users can avail loans between $100 and $5,000 that come with 5.99% to 35.99% interest rates.

- Visit Viva Payday Loans – Consumers throughout the United States can take the benefit of sanctioning a loan of up to $5000 by visiting VivaPaydayLoans.com and simply fill up an online form with the required details. Viva payday loans allow individuals to take a loan irrespective of the occasion, requirements, and budget – all within just a few clicks.

- Complete the application form – Upon visiting the website you can simply choose the amount of cash you would like to borrow along with the tenure of the loan without any upfront fees. Complete the application form by submitting additional details such as your email address, full name, DOB, and more payday loan consolidation

- Get your decision – After submitting the form with the required details Viva Payday Loans will provide you with a decision regarding the loan approval. The website keeps all the information provided confidentially and shares it with the designated lender only. In most cases, the whole process takes around 2 minutes – from the submission of the form to connect with a suitable third-party lender.

- Receive your loan – With Viva Payday Loans, individuals get access to the required loan amount regardless of their credit record. In most cases, it takes 1 or 2 days for the funds to be available with detailed instructions from the lender.

What Are Cash Advance Apps & How Do They Work?

Depending on your earnings, a payday loan will provide you with a short-term credit where a creditor offers high-interest credit. Such short-term financial borrowings are dependent on your upcoming paycheck. In other terms, instead of using a third-party source of funding, you are lending money against your future earnings.

Certain major Cash advance apps assist you to go from one payday to the next by providing you access to your salary a few days ahead of time, thanks to advanced technologies. This way, if you need funds immediately, you may acquire them without charging outrageous interest payments.

Although if your paycheck is still a few days away, a payday loan application compensates you for part of the effort you’ve already put in that week. The software, for instance, sends the $100 you require to loan to your bank account, and then deducts $100 from your next paycheck to settle the fee. It operates similarly to a payday loan, except there is no interest. Once you get your paycheck, you just get the $100 you were given with no interest included. The applications’ developers generate revenue in a variety of ways, such as through optional tips and monthly subscription charges.

Best Cash Advance Apps – Fully Reviewed

1. Viva Payday Loans – Best For Very Quick Cash Advances

Viva Payday Loan app is considered one of the best Cash advance apps due to its ease of use, variety of loan amounts, and variable APR for eligible borrowers. Their website serves as the main portal where anyone could find payday loans for a specific amount by submitting a loan application quickly. It might be easier for people to go with this payday loan app instead of the other alternatives present in the market because this is a more transparent process.

Once approved, borrowers can take out up to $200 to $5,000 as loans from reputed lenders with a repayment period of 2 to 24 months. Usually, it takes 2 minutes to fill up a loan application on the Viva Payday Loans website. In case of approval of your payday loan application, you will be redirected to connect with the various payday loan bad credit lenders who would then decide to lend you the amount requested. Interest rates on Viva payday loans start from 5.99% to 35.99%.

The interest rate varies depending on which direct lender has approved the loan application. These Cash advance apps would sometimes ask for basic information from a borrower to ascertain whether they can repay the loan within the stipulated time or not.

Advantages

-

- Same day payout is available

- The application process takes hardly 5 minutes

- Up to $5000 can be loaned

Disadvantages

-

- People from all states cannot apply

- Automatic monthly debit is used

- Lenders might do a credit check in some cases

2. Credit Clock – Best For Lower Loan Amounts ($100 – $500)

If you need a short-term payday loan then credit clock could be your best bet among many others who claim to be the best Cash advance apps. This broker offers not only payday loans but also bad credit payday loans, personal loans, and emergency loans to borrowers found eligible based on their applications. Fast payouts, easy procedure of loan approval, and allowing even bad credit make credit clock a great payday loan app to check out in your time of need.

The credit clock is not only famous for being extremely helpful in times of need but also for its quick loan approval process that saves a lot of time and disburses cash when the borrower is on a time crunch. All you have to remember before opting for this payday loan app is that you must meet the minimum earning criteria fixed by the credit clock to proceed with a loan application.

All registered and permanent residents of the USA who are above the age of 18 are allowed to use this portal to get financial help from verified lenders that welcome borrowers even with bad credit scores. One might have to prove their residence and income during the process should the lender demands it.

Advantages

-

- Approval is quick

- Disbursement of funds occurs within 24 hours

- People with a bad credit score are allowed

- Available for all 18 above permanent residents of the USA

Disadvantages

-

- Might ask for personal information

- The minimum earning criteria is $1,000 so eligibility depends on affordability

3. Money Lender Squad – Best For Wide Range Of Lender Options

Money Lender Squad is another quality option for those looking for a payday loan online. It offers low APR with no guarantor for US-based residents. With instant approval of loans, Money Lender Squad focuses on borrowers who are usually ignored by other mainstream Cash advance apps. Those who have a bad credit score can also apply for a payday loan with over 60 days to 24 months repayment period and receive funds quickly.

An online form is available on the web portal of Money Lender Squad that needs to be filled up properly and then submitted to be shared with many types of lenders associated with the app. As there are no credit checks required, affordability is a primary concern for most borrowers. The entire process of loan approval and payout is fully automated and all you have to do is wait for a few minutes during which a lender might connect with borrowers with an agreement.

Advantages

-

- Loan terms are extended

- Quick procedure for loan application

- No guarantor needed

- In case of any difficulty, a panel of money lender squad comes forward to assist

Disadvantages

-

- A lower credit score translates to higher interest

- Maximum APR is well over 400% on this app

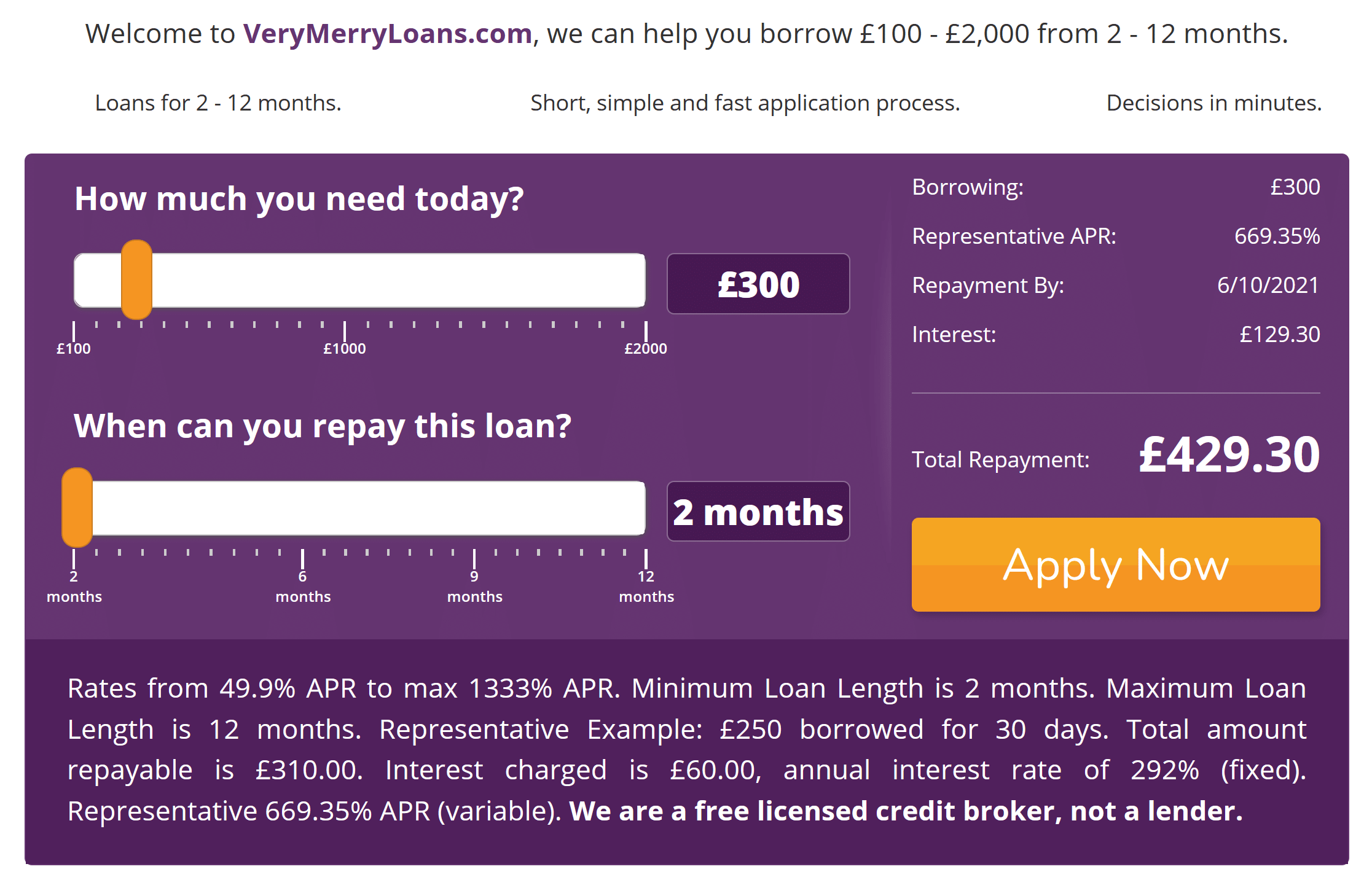

4. Very Merry Loans – Best For Accepting Those With Low Credit Scores

The online platform of Very Merry Loans helps eligible borrowers to connect with capable lenders in the US. Access to its payday loans even for those with bad credit scores is quickly available through this portal. You can get a same-day loan payout within just a few minutes after submitting your loan application properly. Typically it takes almost 24 hours for payday loans to be paid out.

Borrowers need to be above 18 years of age, residents of the USA, have a minimum earning of $1000 per month. Some lenders might ask for proof of residence or identification. Very Merry Loans is known for its simple loan model that presents a panel of verified and well-known lenders that are matched with loan applications from borrowers to pay out their loan requests quickly yet legally. Loan amount on Very Merry Loans ranges from $200 to $5000 so based on one’s requirement they can request a payday loan matching their financial situation.

Applicants repay their payday loans taken from this website over 7 to 31 days but extended loan terms are also available that allows one to repay their loans within 24 months. It is recommended to read all the terms and regulations associated with taking a payday loan from any payday loan app including Very Merry Loans to avoid issues later.

Advantages

-

- Lenders accept unemployed and bad credit borrowers

- APR varies from 5.99% to 35.99%

- Extended loans are available

Disadvantages

-

- Applicants need to be American residents

- High-interest loans have to be repaid within 30 days

5. Heart Paydays – Best For High Approval Rates

Heart Paydays has been an active payday loan app for people living in certain hubs of the US for quite some time now. Their web portal is very easy to use for new visitors because it does not overcomplicate the process of applying for a payday loan online.

The online loan application process can be completed in a short period from the comfort of your home. Borrowers interested in getting a loan for $200 up to $2000 can access the heart paydays portal despite their bad credit score. It takes just over 2 minutes to submit a completed loan application online and usually under 60 minutes, borrowers receive a response from the app regarding their loan request approval and disbursement begins. Heart Paydays is one of the best Cash advance apps because they tend to accept and help out borrowers already rejected from other platforms.

This platform does not distinguish among potential borrowers who are unemployed, have bad credit, and living on government benefits. Heart Paydays offers as much as $5000 loans with 24 months to repay it along with the interest.

Advantages

-

- No phone calls or paperwork needed

- Short term payday loans can be paid within 24 hours

- Loan disbursement takes hardly an hour

Disadvantages

-

- High fees on some loans

- Long term loans incur high interest

Features of Cash Advance Apps

Best Cash advance apps, if utilized correctly, can prevent you from getting a bank overdraft charge and offer immediate cash to get you through until your next payday. Some applications also offer budgeting features, low-interest credit-building borrowings, and other functionalities.

Speed of approval:Â The approval process may vary from app to app that can range between minutes and even 3 days in some cases. At vivapaydayloans.com, users can expect a decision regarding their loan approval within 2 minutes.

Loan amount:Â Payday loans borrowed from certain apps are generally of small amounts that can range from $5 to $5000. For instance, viva payday loans grant loans amount from $100 to $5000 for customers throughout the United States.

Repayment options: Typically the amount is usually deducted out of your account on the day you’re supposed to get your following payment, which is usually your upcoming payday. In case the account is insufficiently funded, the apps will attempt to withdraw the funds multiple times until a certain period. You’ll be charged a late fee if your payment is delayed more than the limited period set by the app’s guidelines.

Fees:Â Usually these apps generate revenue from voluntary tips and monthly subscription charges.

While most Cash advance apps only provide access to paycheck prematurely, some of them also offer features like online banking services, investing, and more.

Types of Cash Advance Apps

Cash advance apps that work with Chime: Dave, Cleo, Albert, Empower, MoneyLion, Varo.

Cash advance apps that don’t use Plaid: Applications except for SoFi, Figure, Petal, Avant.

Cash advance apps that work with Netspend:Â Usually with a Netspend account, users cannot take a payday loan. However, with Netspend prepaid cards, one can take cash credits to their card account directly and can also have the option to deposit credit proceeds from other institutions to their account.

Cash advance apps that work with Varo:Â Varo Bank app, also known as Varo Advance. Users can also connect Varo with Chime.

Cash advance apps that work with PayPal:Â Apps such as PayPal working capital, CashspotUSA, are to name a few.

Cash advance apps that work with prepaid cards: Applications such as Brigit and Empower.

Advantages and Disadvantages of Cash Advance Apps

The preference for Cash advance apps in today’s time comes down to the array of benefits they serve.

With technological advancement, it’s never been easier or faster to get a payday loan. Some applications may deposit funds into your bank account right away, although they may charge a premium for this service. Easily log onto the app, pick the amount you want to borrow and your application will be either be granted or not in minutes. If it’s pre approved, the funds are transferred to your checking account right away. However, dependent on the creditor, the approval period may vary in most cases.

The credit check is used when requesting personal loans. But in the case of payday apps, most of them don’t even check your credit. The majority of financial applications make decisions based on how much you make and how much you want to loan before your next payday. When you ask for funds, the application evaluates to see whether you can repay it and either accepts or refuses your application, allowing you to get no credit check loans.

- Opportunity to build credit

Even if you’re taking out loans through an app and it doesn’t seem like you’re getting a regular loan, the process can still affect your credit rating. Since most financial applications only provide borrowing of just a few hundred bucks, you may take out many loans throughout the year and repay them off promptly and completely. Each time you properly settle a loan, you accumulate points toward your credit rating.

Apart from the benefits, as a consumer, you must also be familiar with the drawbacks of such apps to properly evaluate your decision of opting for such applications.

- Chances of getting into a debt loop

Since applications enable lending from your upcoming paycheck simple, users who depend on loans to cover monthly costs may find themselves in a cycle of debt. It’s easy to have financial support at your disposal, but it’s also risky in most cases. You could find yourself asking for personal loans more frequently than you are supposed to, which isn’t good for your salary when it arrives in your account.

Eligibility Criteria

At Viva Payday Loans, individuals fulfilling the following criteria are eligible for payday loans through the app.

- An individual must be over the age of 18 to apply

- Need to have a permanent address proof

- Earns $1000 or more as a regular monthly income

- Holds a valid checking or savings account with direct deposit

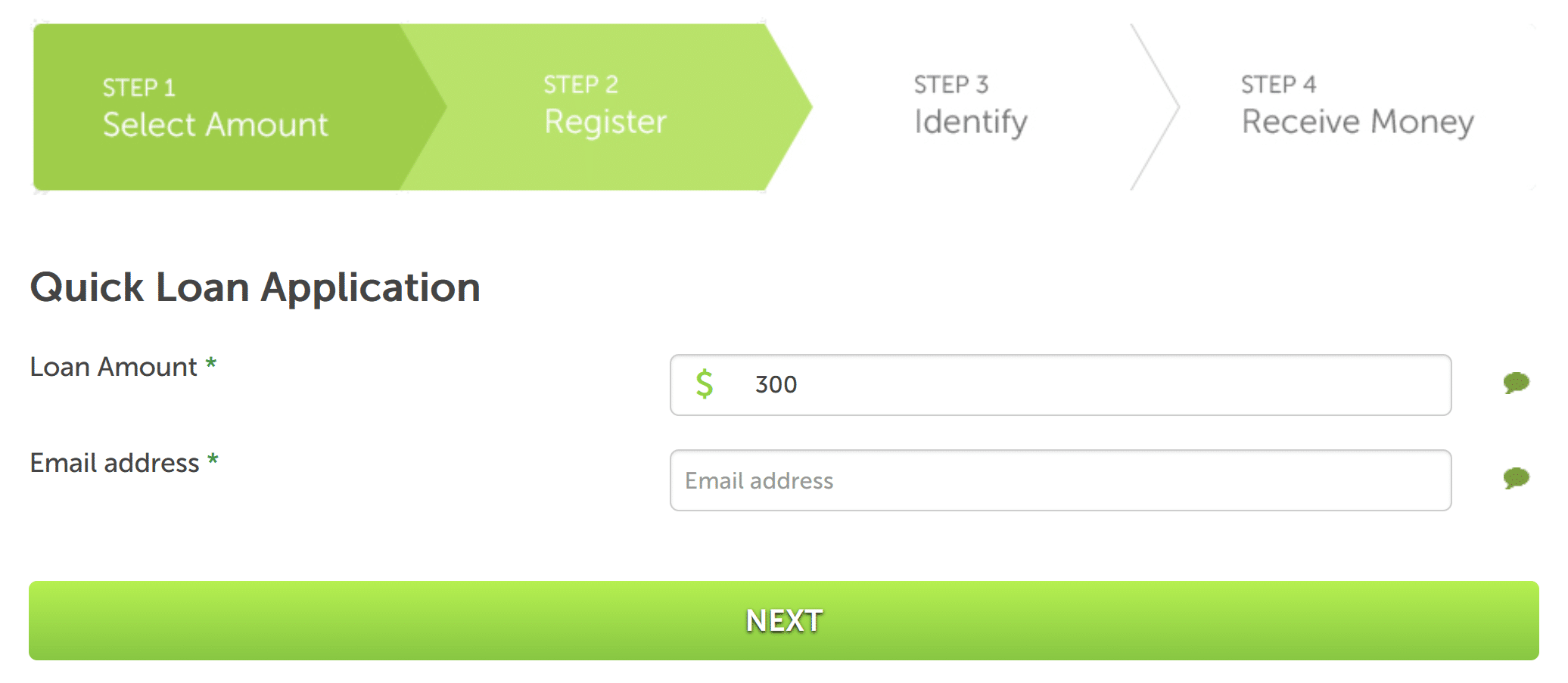

Application Process

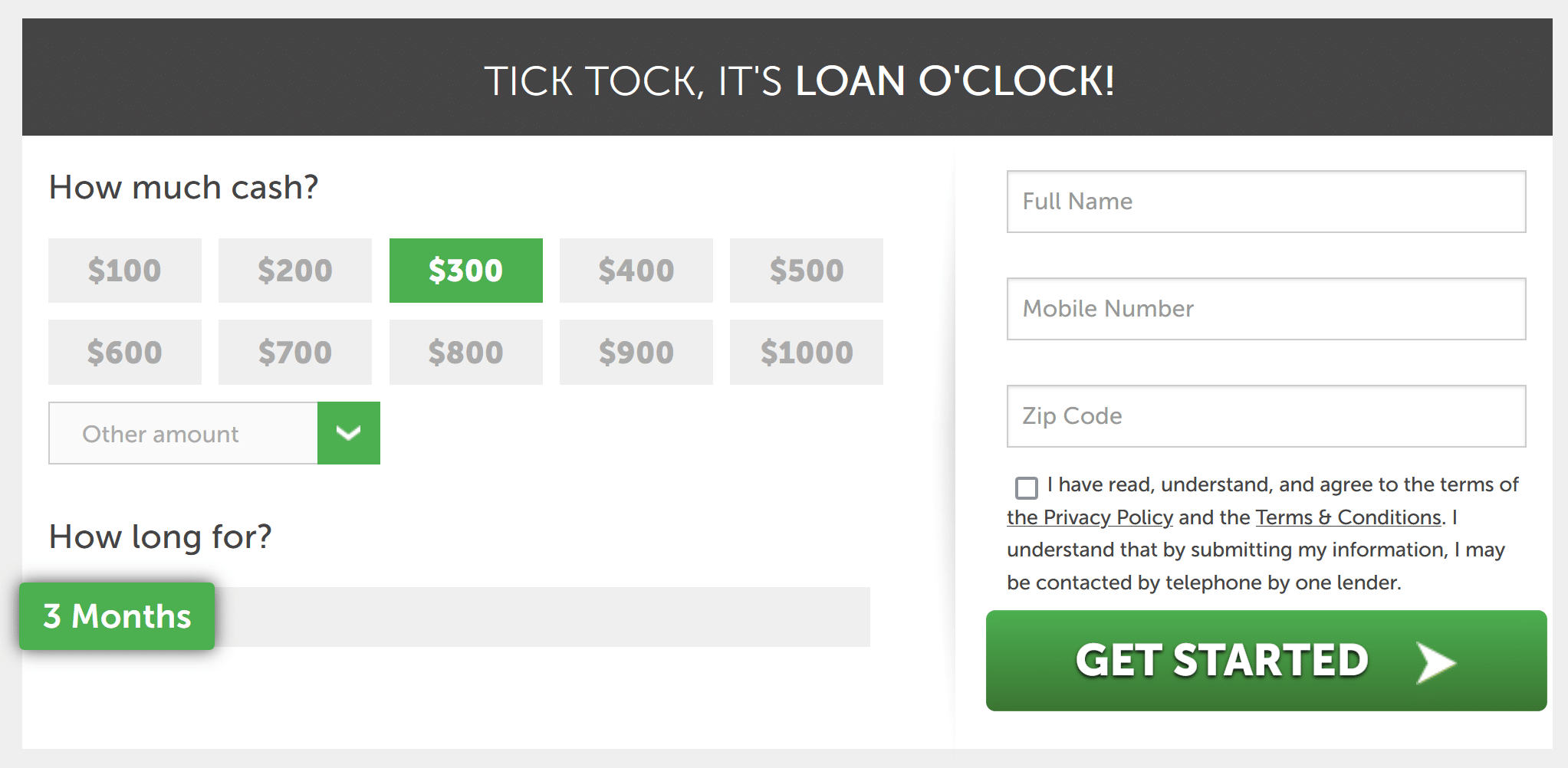

At Viva Payday Loans, users can apply for payday loans in three simple steps.

Step 1: Select your loan amount & term

Viva Payday Loans are brokers who lend users up to $5000 for 3 to 6 months. To apply for the process, simply visit their website and choose the required loan amount with appropriate tenure.

Step 2: Complete the application

After submitting the basic information, you are required to put additional details like name, email address, cell phone number, and more.

Step 3: Wait for a decision within 2 minutes

After final submission, viva payday loans will evaluate the information to provide the decision whether your loan can be approved or not. The whole process typically takes up to a minute or two. Upon connection with a suitable lender, you will get access to the funds within 24-48 hours.

Request Payday Loan at Top-Rated Provider – Viva Payday Loans

FAQs

What credit score is required for getting a payday loan online?

What are the things to prepare before applying for payday loans?

How does no credit check payday loans work?

How to apply for a payday loan?

Are payday loans going to affect my credit score?